Contents

In Australia, the brokerage firm is regulated by the Australian Securities and Investments Commission . You will also need to provide documented proof of your address and identity before you can withdraw funds. A webinar is an interactive online event in which a speaker delivers a presentation to a large audience who participates by asking questions, replying to polls, and using other interactive technologies. EasyMarkets telephone Support is often used for pre-sale queries, order taking, or even upselling and cross-selling, and troubleshooting.

Who are EZ markets?

About Ezmarkets

EzMarkets has evolved into a global internet trading service that will ensure your success. We aim to give a different and clear trading system. For many years, we have noted a shortage of a diverse and well-informed trading supplier.

This process usually takes less than 24 hours, after which time you can begin trading freely. At the time of this review, easyMarkets offered three promotions; a first deposit bonus, a partnership programme, and a refer-a-friend bonus. The MT4 trading platform is provided as the basic version only but remains the best choice available at easyMarkets.

See all easyMarkets Indices products

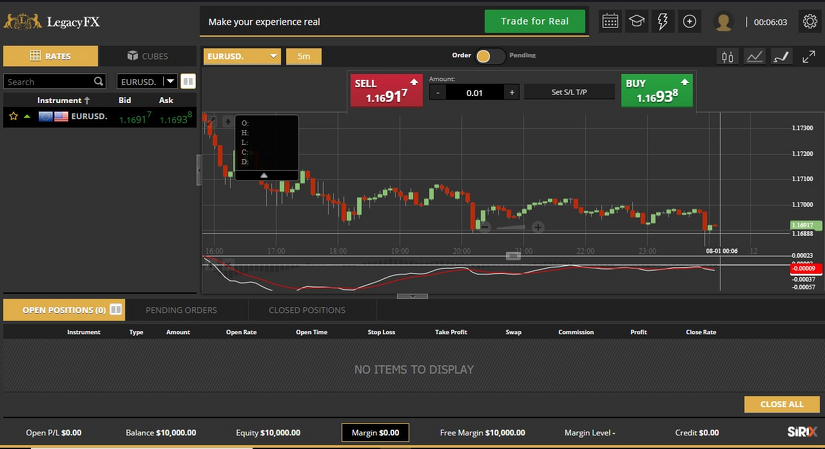

With a feature-rich, intuitive user interface and a highly customisable trading environment, the MetaTrader 4 software meets all of your trading demands and improves your trading efficiency. Additionally, traders can gain trading insights from daily technical and fundamental research as well as trading indicators. The company offers Standard, Premium, and VIP accounts for non-European customers. Along with everything else, easyMarkets offers new and experienced traders a variety of advantages that merit further investigation.

I read an article on as regards to a recovery expert and genius so I reached out to SCAM RECOVERY SITE, and to my surprise I got all bitcoins recovered within 24hours frame. I don’t know if I’m allowed to share the links on here but you can contact them if you are finding it very difficult to withdraw your funds at, Scamrecoverysite at fastservice dot com All thanks to them. Support is offered 24/5 via email, live chat, messenger services, and telephone in a range of languages, including English, Chinese, Arabic, Spanish, German, Polish, Japanese. EasyMarkets’ customer support is average compared to other international brokers. All UK residents are eligible to open an account at easyMarkets as long as they meet the minimum deposit requirements. Additionally, easyMarkets is frequently audited by its regulators and uses these opportunities to identify areas of potential risk in their operations, ensuring constant improvement of internal processes.

Futures trading is where derivative financial contracts obligate a buyer to purchase an asset or a seller to sell an asset at a predetermined future date and set price. A easyMarkets futures contract allows an investor to speculate on the direction of a security, commodity, or financial instrument. Typically, futures contracts are traded on an exchange such as easyMarkets; one trader agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date.

Formerly known forex broker easymarkets or easy-forex never lets you withdraw your fund at all. In an attempt to attract as many traders as possible easyMarkets Forex broker offers several promotions and offers, these programs include bonuses, referral, and partnership programs. As an established broker with almost twenty years of trading experience under its belt, easyMarkets is a simple but welcome platform that offers several advantages over its competitors. Information-wise, easyMarkets has plenty to offer, including the latest news headlines and a financial calendar. These features are important for real-time analysis and can help to maximize profits.

Traders should note that easyTrade is only available on 20 financial instruments. Additionally, the easyMarkets platform does not cater for third-party tools. As such, easyMarkets segregates all client funds at top-tier banks around the world.

The goal of effective UI is to make the user’s experience easy and intuitive, requiring minimum effort on the user’s part to receive maximum desired outcome. The UI design of the easyMarkets application improves user experience and customer satisfaction, ultimately helping increase the number of users of the easyMarkets application. Apple Macs and MacBooks can easily handle the most important requirements when using the easyMarkets trading platform. This includes the ability to have multiple browser tabs or trading apps open, a high quality display or monitor , an accurate trackpad or mouse, lightweight design, and long battery life. A Mac can go from cold boot to live trading using just a couple of mouse clicks and in well under a minute.

When trading with easyMarkets at some point you will want to release your funds back to your bank account or other withdrawal method. Many modern trading platforms offer withdrawal of your trading account balance to digital wallets and direct bank transfers. Depending on your geo region certain withdrawal methods may be more convenient to you.

Maximum leverage

While the user-interface looks modern and clean, it doesn’t support automated trading or allow the introduction of third-party plugins which many traders find to be helpful, if not entirely necessary. Two of the core features marketed by this broker, dealCancellation and Freeze Rate, are exclusively granted in this platform. The easyMarkets webtrader also comes with a hidden cost to traders in the form of higher spreads, which is quite unfortunate, and may serve as a deterrent from traders choosing this option. Options trading is provided through this platform as well, and traders who seek the full range of products and services offered are forced to pay more for access to them. It is user-friendly and can suit any type of trader at any skill level. It has a lot of features for experienced traders yet is friendly to use for new clients.

What is the best leverage for a beginner?

What is the best leverage level for a beginner? If you are new to Forex, the ideal start would be to use 1:10 leverage and 10,000 USD balance. So, the best leverage for a beginner is definitely not higher than the ratio from 1 to 10.

New accounts are opened online, and the process is surprisingly short at easyMarkets. Traders are initially only required to prove their e-mail address and create a password or connect through their Google or Facebook account. However, when reading through the Client Agreement , it becomes clear from the Know Your Customer section that new traders are required to verify their account as mandated by regulatory requirements. This is usually completed by submitting a copy of the trader’s ID and proof of residency document. The research section consists of six categories, unfortunately, all not specifically valuable to traders. The information can be more efficiently retrieved from within the MT4 trading platform.

Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives.

easyMarkets revieweasyMarkets Withdrawal Fees

Overall, easyMarkets’ education section is helpful to get beginner traders started in their trading careers, but it would do well to add materials for more advanced traders. EasyMarkets provides a good selection of educational materials for beginner traders, but lacks materials for more advanced traders. EasyMarkets Mobile trading apps are average compared to other brokers. Upon logging in, traders are welcomed by a list of asset classes and products on the left-hand side, a trading ticket in the middle of the screen, and a comprehensive trading tool on the right.

The good news is that there are no fees charged by easyMarkets for either withdrawals or deposits. EasyMarkets launched the one of the world’s first web-based trading platform in 2001 with a plethora of asset classes, including forex, commodities, stocks and options. EasyMarkets features competitive fixed dealing spreads, dealCancellation and easy risk management options. You’ll also find MetaTrader 4 and easyMarkets’ own web-based and mobile platforms at your fingertips. When trading with easyMarkets, there are a variety of payment options accessible; different brokers support different deposit and withdrawal methods. Each trade payment option has its own set of benefits and cons in terms of costs, processing times, and limits.

Their regulation policy ensures that the company funds are separated from the clients’ funds to ensure transparency and integrity. On the other hand, the good old MetaTrader 4 provides the possibility to use MultiTerminal mode tailored for advanced traders. In case are of the auto trading type, the broker enabled EAs for you on MT4 too. Last but not the least exceptional feature is the negative balance protection on MT4. Besides offering MetaTrader 4, easyMarkets also developed its proprietary web-based platform. While MT4 is downloadable, the EeasyMarkets platform can be opened in browser provided that you have a stable Internet connection.

EasyMarkets trading accounts are available in over 194 countries. A easyMarkets account fee is a fee that easyMarkets assesses on all accounts for the ability to keep an account on their platform. An account fee compensates trade360 review easyMarkets for the cost of keeping the account open. For easyMarkets you may pay a monthly fee for your account in return for benefits, most often research tools, educational guides, or premium perks.

The whole notion of offering fixed spreads is to provide traders with the best possible trading conditions. EasyMarkets also offers competitive conditions, contracts, and leverage that are accessible to both novice and experienced traders. Since there are no commission fees on deposits or withdrawals or account inactivity, easyMarkets generates most of its revenue from fixed dealing spreads. These spreads remain unaffected by market volatility but vary with the trading account, instrument, and the platform.

What is easyMarkets and Easy Forex?

Their prices were so out of kilter with the real market confusion reigned supreme. I like their fixed spread, it never changes which makes me trade easily because am aware of my trading expence even before opening any position. I hate variable spreads because sometimes they can manipulate to trigger your sl. broker gkfx – Regulations, proprietary platform, unique features and traders ratings. EasyMarkets keeps all traders’ funds in segregated top-tier bank accounts to prevent their misuse.

The broker distinguishes itself from all other online brokers thanks to these advantages. Check out each of the below pros and cons to have a better grasp of easyMarkets. In this review, you can find all the information you need to decide whether easyMarkets is the right broker for you. Our expert team has thoroughly explored the broker, using a tested methodology and scoring system.

It offers its clients multiple ways to deposit and withdraw funds including bank transfer, credit, debit, online cards, and a selection of eWallets. The firm also doesn’t charge any fees for funding or withdrawing from your account. trading for beginners The minimum initial deposit is $25 and commits to its core concept of honesty by being transparent to its clients with no hidden fees. Traders are able to customize and create trading templates or choose from pre-designed templates.

What Are The Unique Advantages Of An easyMarkets Account?

Each withdrawal method has its own withdrawal time which you will have to check before withdrawing your easyMarkets account balance. EasyMarkets may have minimum withdrawal limits that you will need to check before withdrawing. Leading brokerages offer apps to their clients who are able to use them to trade in shares, invest in mutual funds, or in initial public offers, and even monitor their entire portfolio. All an investor needs is a Web-enabled smartphone and a trading account with easyMarkets.

The deal Cancellation tool offers you a limited window of opportunity, up to a maximum of six hours, to choose whether to cancel your trade and recover your losses for a modest cost. In addition, one can freeze a quote for three seconds using the Freeze Rate button. It is well-regulated and has a strong track record since it has been in business since 2001. EasyMarkets has a very high trust score, compared to other brokers.

How do I deposit money into an IC market?

IC Markets offers its customers several ways of depositing funds into their trading account. Common deposit methods include bank / wire transfer, Paypal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli.

EasyMarkets has been paving its way to success from the year 2001. Initially starting with Forex trading products, it significantly enhanced its product scope as the company evolved. All of these features help prevent you from suffering unexpected losses and keep your investment safe. The material does not contain investment advice or an investment recommendation,or, an offer of or solicitation for, a transaction in any financial instrument. If you’re having a withdrawal transferred to your digital wallet account, your easyMarkets should arrive in less than 24 hours. You may anticipate to receive your money within three business days for bank transfers, credit/debit cards, and digital wallets.

easyMarkets revieweasyMarkets Account Types

It is intuitive, powerful, and simplified, making it suitable for beginner traders. While the user interface looks modern and clean, it doesn’t support automated trading or allow the introduction of third-party plugins which many traders find helpful. However, additional trading features that set easyMarkets apart from its competition like dealCancellation, Freeze Rate, and Inside Viewer are only available with this on this platform . EasyMarkets, in its original iteration as easy-forex, was founded as a Forex broker in 2001 with the overarching goal of democratizing Forex trading. To that end, easy-forex advanced minimum deposits from $25 by credit card which was viewed as a pioneering step across the industry. In 2016, the brokerage introduced CFD trading and, at the same time, re-branded itself from easy-forex to easyMarkets.

The “Getting Started” section features four videos that deal with the basics of trading such as leverage, pips, and currency pairs. Each video is loud, clear, and precise, featuring full-on animations and a professional presentation. This is designed specifically to help traders gain information, knowledge, and strategies to help them make the right trading choices. New clients outside the EU receive a first deposit bonus of up to 50% on their initial deposit.

Review of the deposit and withdrawal

This platform is as well as preferred by advanced traders because it shows an amount of information displayed in one window. EasyMarkets offers platforms for web, desktop, and mobile trading. This platform is well-developed and promotes simple trading as the core concept of the broker’s brand.

Add a Comment